Measuring Real Estate Investment Returns: A Data-Driven Framework

Measuring Real Estate Investment Returns

Performance Overview: The Dual-Return Mandate

At Green Energy Estate Fund LLC, we measure real estate investment returns through a dual mandate: delivering strong financial performance and tangible ESG real estate performance. This strategy is designed to meet today’s market realities—particularly in regulated environments like California—where sustainability is directly linked to asset resilience and long-term value creation. Our proprietary backend framing engine connects project-level data to portfolio-wide analytics, giving investors a unified, predictive view of each asset’s financial health and environmental resilience. This goes beyond traditional, backward-looking reporting by offering forward-looking insights.

Granular Financial Performance Metrics

Our platform provides clear and timely financial performance metrics, ensuring full transparency for all fund operations and returns. Investors can monitor Internal Rate of Return (IRR), Cash-on-Cash Return, Net Asset Value (NAV) growth, and detailed budget-versus-actuals throughout every project phase. Financial discipline is embedded in our fund structure, featuring an 8% preferred return for investors and a transparent waterfall distribution model. All capital disbursements undergo dual-authorization and third-party fund control verification, aligning manager incentives with investor interests and protecting capital.

Quantifiable ESG Real Estate Performance

We transform sustainability goals into measurable outcomes that correlate with financial results. Our approach to ESG-focused property outcomes includes systematic tracking of metrics such as energy-use intensity, construction waste diversion, water savings, and carbon offset equivalents. These core operational KPIs are reviewed quarterly and provide leading indicators of risk mitigation and cost reduction. Our ESG data aligns with global frameworks like GRESB, enabling investors to benchmark portfolio performance against industry peers using validated, standardized methodologies.

The Architecture of Investment Transparency

The Data Pipeline: From Project Site to Portfolio

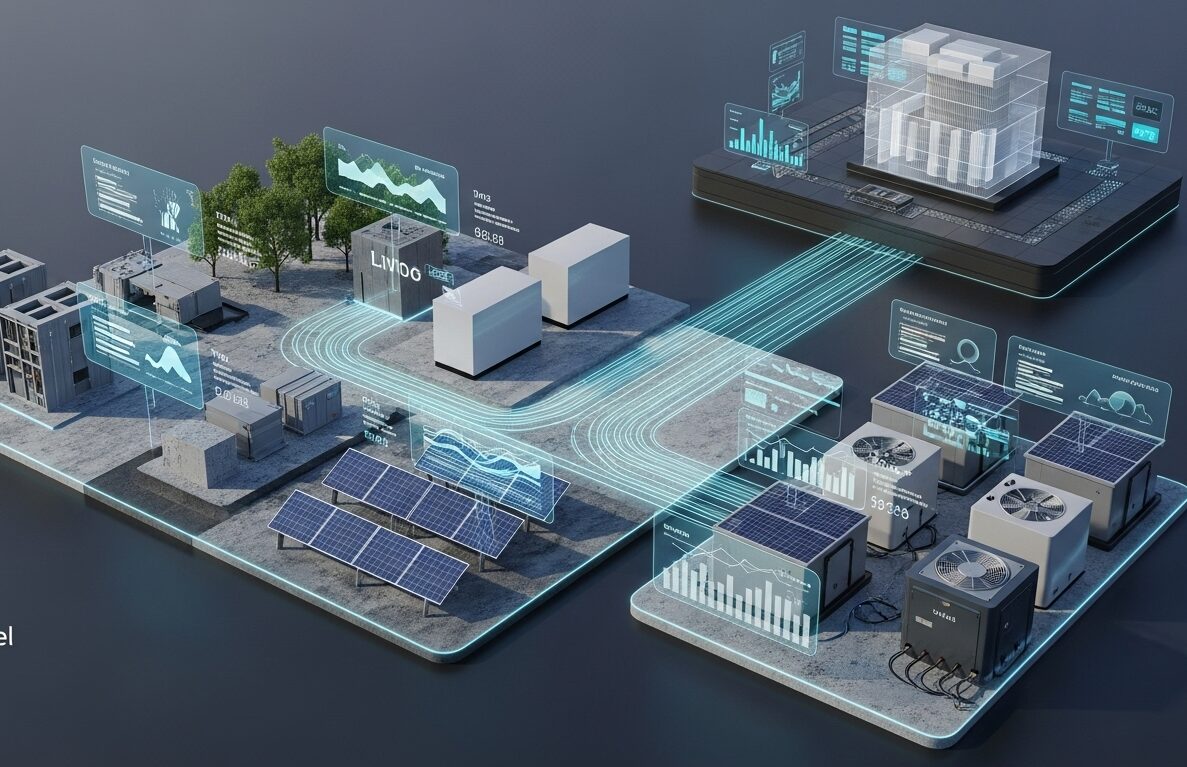

We leverage advanced construction and energy technologies—such as prefabricated LIVIO Steel, IoT-enabled Tesla Solar Panels, Powerwalls, and geothermal HVAC—to provide real-time, high-fidelity performance data. “Digital twin” technology enables continuous monitoring of energy use, water consumption, and indoor air quality, ensuring our ESG reporting is both accurate and transparent. This robust data infrastructure allows us to analyze utility cost impacts, anticipate maintenance needs, and deliver a forward-looking view of asset health.

The Investor Dashboard: Centralized Real Estate Investment Returns Analysis

- Portfolio View: Aggregates overall fund performance and ESG impact.

- Asset-Level Drill-Down: Isolates individual property financials and ESG data.

- Custom Reporting: Generates tailored reports by time period or metric.

- Document Vault: Provides secure, 24/7 access to all official fund documentation.

California Sustainable Real Estate Investing

The Financial Case for Green Building ROI

Sustainability is central to our strategy for financial outperformance. Certified green buildings deliver significant operating cost reductions—often 25% to 30% lower than conventional properties—thanks to high-performance systems and smart energy management. These savings boost Net Operating Income (NOI) and asset value.

Read the business case for green building.

Sustainable properties also command market premiums, achieving up to 9% higher rents and improved occupancy rates due to rising tenant demand for healthy, efficient spaces. This translates to risk mitigation and long-term value creation across our portfolio.

Exceeding California’s Regulatory Standards

Our projects are designed to surpass California’s strict standards, such as Title 24 and CALGreen, ensuring our assets remain at the forefront of energy efficiency, water conservation, and indoor environmental quality. This proactive approach reduces regulatory risk and enhances asset value.

By leveraging local incentives, like those from the City of Palmdale’s EPIC Energy, we further de-risk projects and maximize real estate investment returns.

A Data-Driven Look at the Palmdale Project