Fund Structure – How Green Energy Estate Fund Works

Overview of the Fund Structure

How Your Investment Is Deployed

Capital Commitment

Investors commit upfront, establishing a foundation for long-term real estate acquisitions and stable returns

Capital Calls

The fund issues capital calls as needed, optimizing the flow of funds into critical development phases

Project Deployment

Committed capital is deployed efficiently from land acquisition to renewable energy installations and property management.

Prioritizing Investor Income

Initial Return Priority

Investors receive the 8% return on their capital contributions before management shares in profits, prioritizing your investment.

Stability and Predictability

This structure offers reliable income for investors, making it an attractive choice for those seeking consistent returns in sustainable real estate.

For more details on priority returns in private real estate funds, check out Investopedia.

Performance-Based Incentive

Once returns are met, remaining profits are split between investors and fund managers through a structure known as carried interest.

- Profit Sharing Model:The typical incentive allocation split is 70/30, where investors receive 70% of the remaining profits, and fund managers receive 30% after returns are distributed.

- Incentive for Fund Managers:This model ensures fund managers are compensated only after investors have received their expected returns, aligning the interests of both parties. By incentivizing managers to surpass the preferred return threshold, we ensure a focus on optimal performance for investors.

This performance-based incentive keeps fund managers dedicated to maximizing returns through effective project execution and risk management.

Waterfall Distribution: Profit Allocation

Return of Capital

Investors receive their initial capital investment back first.

Preferred Return

Investors are paid the 8% preferred return on their invested capital

Profit Share

Remaining profits after the preferred return are split 70/30, with investors receiving 70% and managers 30%.

This model guarantees that investors receive their share of profits before fund managers benefit, creating a fair and transparent system for all participants.

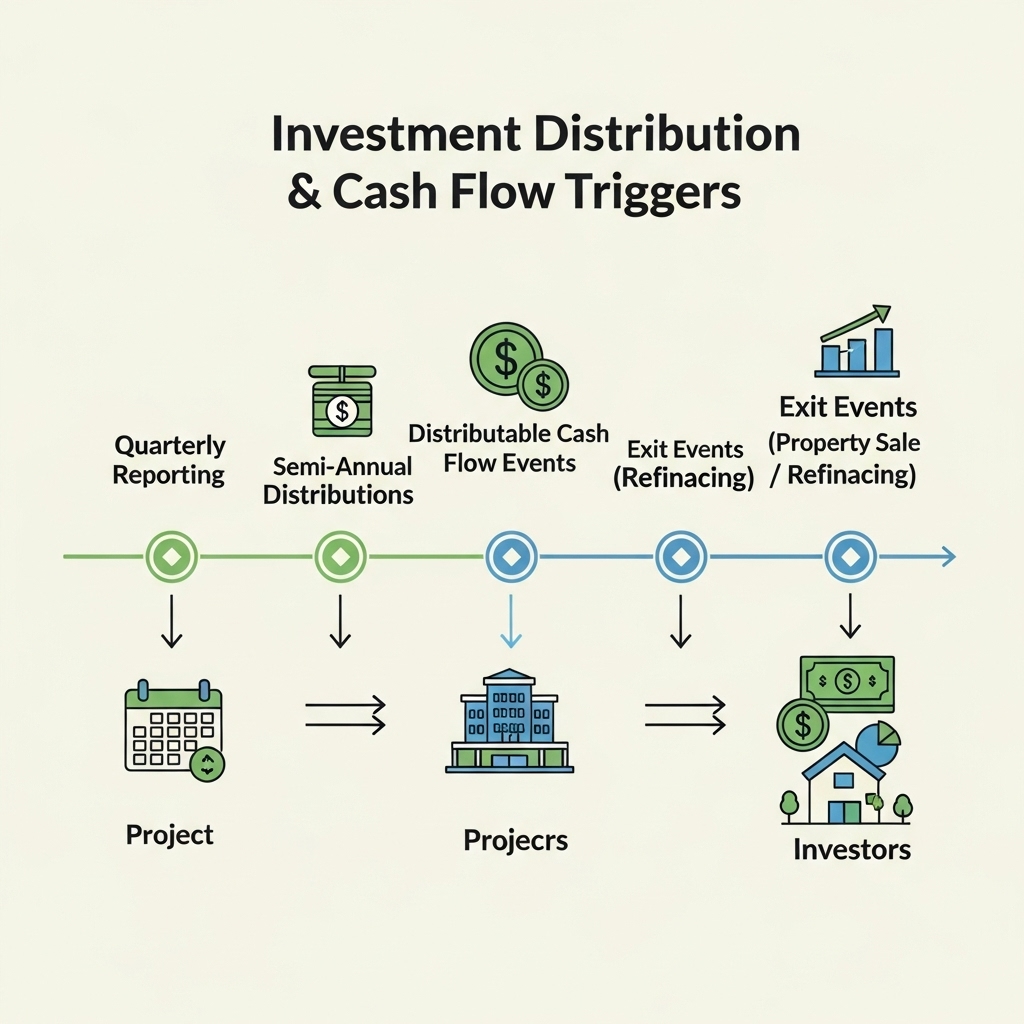

How Distributions Occur: Timeline and Triggers

- Quarterly Reporting: Investors receive quarterly updates, but distributions are typically made semi-annually or annually, depending on project cash flow and profitability.

- Distributable Cash Flow: When a project generates income from sales, rental cash flow, or refinancing, available funds are distributed to investors first, following the preferred return structure.

- Exit Events: Upon property sales or refinancing, the distribution model applies, allocating profits to investors before fund managers receive their profit-sharing incentive.

These transparent distribution rules ensure that investors are informed and that returns are delivered on a predictable schedule.

Secure Your Future with Green Energy Estate Fund